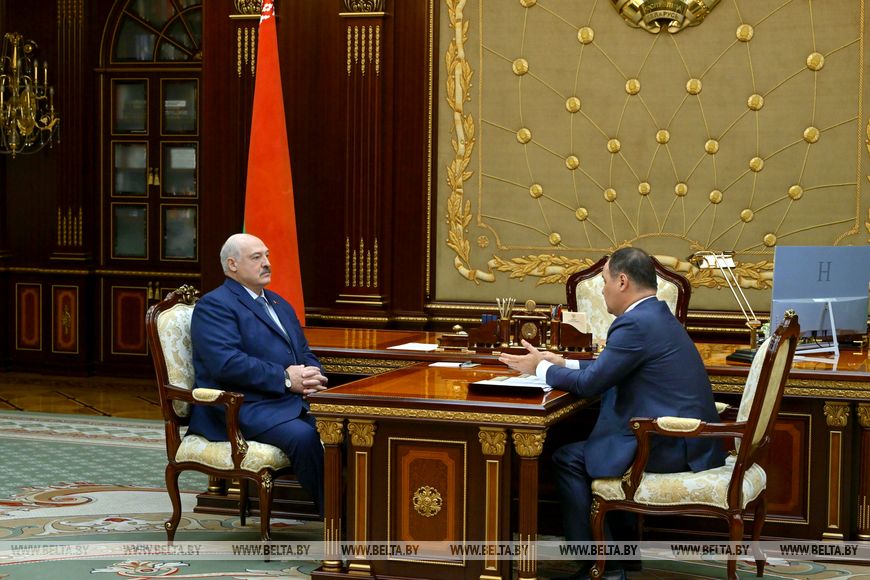

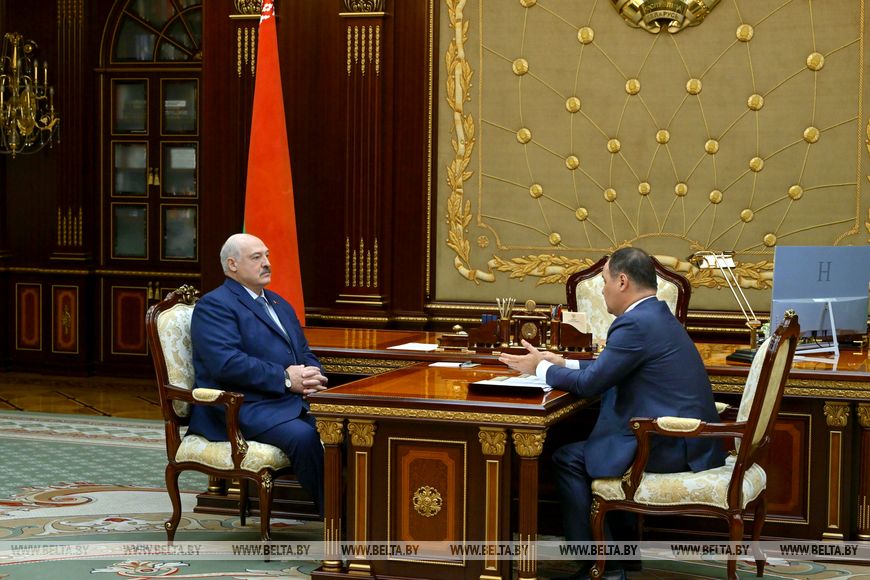

MINSK, 12 August (BelTA) - The National Bank of Belarus and the banking system are successfully fulfilling the assigned objectives. The current situation is assessed as positive, Chairman of the Board of the National Bank Roman Golovchenko told journalists following his report on the banking sector performance to Belarusian President Aleksandr Lukashenko in Minsk on 12 August, BelTA learned.

Roman Golovchenko provided President Aleksandr Lukashenko with a detailed briefing on the implementation of objectives set for the new board of the central bank. The head of the National Bank described the current situation in this sector as positive. "The president appeared to share this assessment. Both the banking system and the National Bank itself are successfully meeting the targets, with concrete figures and facts substantiating this progress,” Roman Golovchenko told reporters.

Deposit sector performance

Deposit sector performance

There is the price and financial stability, Roman Golovchenko said. Households remain active in financial market operations, with the deposit sector also showing growth. “Notably, we saw the strongest growth in national currency deposits. Currently, nearly 73% of all deposits are held in Belarusian rubles, with a term exceeding one year. This provides a solid resource base for investment," Roman Golovchenko emphasized.

On investment lending

The National Bank of Belarus has implemented all necessary measures to stimulate investment lending. Over the past six months alone, approximately Br3 billion has been channeled into value-added investment projects.

"The interest rate policy of banks, which is influenced by the National Bank, also enables investments to be made under favorable conditions. The average interest rate for such loans is below 10%. This represents what we might call an acceptable 'price of money' for investment and development," he said.

On consumer lending

Regarding retail lending, Roman Golovchenko emphasized the need for controlled lending practices: "We must prevent excessive financial burden on our citizens while ensuring that consumer credits are primarily issued for domestically produced goods and services.”

He noted significant progress in this area as well, with lending for Belarusian-made goods up by approximately 35% over the past six months," Roman Golovchenko said.

The head of the National Bank noted he had received valuable insights from the head of state regarding the most pressing issues in international politics, a domain in which the president has deep expertise. “This exchange was extremely valuable for me and will inform certain decision-making processes," Roman Golovchenko stated. "Naturally, finance is deeply intertwined with politics. Global developments have a direct impact on financial markets.”

Deposit sector performance

Deposit sector performanceThere is the price and financial stability, Roman Golovchenko said. Households remain active in financial market operations, with the deposit sector also showing growth. “Notably, we saw the strongest growth in national currency deposits. Currently, nearly 73% of all deposits are held in Belarusian rubles, with a term exceeding one year. This provides a solid resource base for investment," Roman Golovchenko emphasized.

On investment lending

The National Bank of Belarus has implemented all necessary measures to stimulate investment lending. Over the past six months alone, approximately Br3 billion has been channeled into value-added investment projects.

"The interest rate policy of banks, which is influenced by the National Bank, also enables investments to be made under favorable conditions. The average interest rate for such loans is below 10%. This represents what we might call an acceptable 'price of money' for investment and development," he said.

On consumer lending

Regarding retail lending, Roman Golovchenko emphasized the need for controlled lending practices: "We must prevent excessive financial burden on our citizens while ensuring that consumer credits are primarily issued for domestically produced goods and services.”

He noted significant progress in this area as well, with lending for Belarusian-made goods up by approximately 35% over the past six months," Roman Golovchenko said.

Banking profits and foreign exchange reserves

The banking system is successfully fulfilling its objectives while generating solid profits. Together with the Development Bank, the sector's half-year profits reached approximately Br3 billion, marking a significant increase compared to the same period last year. Banking sector profits naturally serve as a source for increasing equity capital and funding strategically important national projects," emphasized Roman Golovchenko.

The head of the National Bank added that the central bank is fulfilling its statutory mandates: "We recently achieved a record level of foreign exchange reserves of over $12 billion.”

On the refinancing rate

Roman Golovchenko believes that the current refinancing rate remains appropriate. "At this time, we see no need to tighten the monetary policy, particularly through rate hikes. A rate cut may even be possible. However, the National Bank is closely monitoring the situation and stands ready to take action if necessary," Roman Golovchenko assured.

According to him, the economy currently has sufficient money supply. “The monetary base is fully capable of meeting the economy's investment needs and, consequently, supporting its development. However, we are meticulously monitoring all ongoing processes. The National Bank employs highly skilled professionals equipped with a comprehensive toolkit to respond adequately and promptly to the evolving situation.”