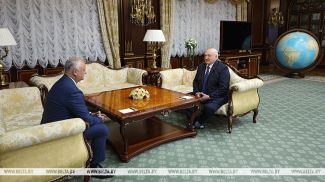

MINSK, 7 February (BelTA) – Belarus President Alexander Lukashenko upheld the initiative of the National Bank of the Republic of Belarus (NBRB) to step up efforts to ensure financial stability as he met with NBRB Chairman of the Board Pavel Kallaur on 7 February, BelTA informs.

At the beginning of the meeting, the president suggested discussing the further actions and strategies of the National Bank to maintain financial stability, including some new measures. “At the current stage, the National Bank deems it necessary to get more powers following in the footsteps of foreign regulators. In order to enhance financial stability, we need some additional amendments to our legislation. I want to know what kind of amendments you want. This will help me better understand what we should do, and whether we should accept this proposal or not. However, I absolutely support the suggestions I have just heard,” Alexander Lukashenko said.

Pavel Kallaur, in turn, noted that the country maintains price and financial stability, as it is a basic condition for economic growth and improvement of living standards of people.

Following the meeting, Pavel Kallaur informed that it is particularly important to preserve a macroeconomic balance in the time of challenges and geopolitical uncertainty around the world. “Maintaining financial stability is a very important element of the macroeconomic policy in general. This matter was in focus during today's meeting, as well. Financial stability is not just about robustness of the banking system and other financial intermediaries, financial markets and the payment system in the given moment. Financial stability is about resilience of all these components to external shocks,” Pavel Kallaur said.

He emphasized that the system should be able to respond adequately to emerging challenges in order to maintain sustainable economic growth. “The head of state upheld the corresponding initiative of the National Bank,” Pavel Kallaur said.

He explained that today the head of the National Bank bears a personal responsibility for ensuring financial stability. The National Bank is responsible for monitoring financial stability. There is a proposal to formalize the responsibility of the National Bank to facilitate efforts to maintain financial stability.

According to Pavel Kallaur, responsibility should go hand in hand with the necessary instruments. This pertains to the macroprudential regulation and policy, the tools that would buttress this policy. “There are a number of such tools in international practices. Some of them are already used here, like the limitation of debt burden on consumer debts. This is designed to prevent individuals from being overburdened with debt. Another tool we are about to introduce is a standard risk measurement. It will be in effect from 1 March. This instrument is meant to protect markets from excessive volatility and excessively risky business operations by banks, in order to avoid systemic risks,” Pavel Kallaur said.

“When we are talking about financial stability in general, we mean that we should hedge against systemic risks, rather than cause them,” he noted.

Pavel Kallaur specified that the National Bank teamed up with the government to chart approaches to preventing systemic risks. When the documents are ready, they will be submitted for scrutiny to the head of state.

This policy at large is designed to curb systemic risks and ensure resilience against all kinds of shocks. “For households it is about a stable and predictable environment, a possibility to plan finances for the future; for businesses it means an opportunity to draft their business plans in the right way,” Pavel Kallaur said.

When asked whether granting the National Bank a mega-regulator status is still on the agenda, he noted that the regulation of the securities market and insurance companies is and will be the responsibility of the government in the near future.