MINSK, 22 July (BelTA) – Approaches to taxing self-employed businessmen will be changed in Belarus by 2023, BelTA learned from Belarusian Finance Minister Yuri Seliverstov after a government conference held by the head of state on 22 July.

Yuri Seliverstov said: “We enabled conditions conducive to the development of entrepreneurship in the past. We still say it is necessary. The government does not go back on these words. But from the point of view of taxes we have too many taxation regimes, which allow either hiding earnings or minimizing them by using various options. On the other hand, those, who work honestly, need simple and understandable terms: register your business, pay taxes, and we will have no complaints about you.”

In his words, it is necessary to simplify business operation for honest taxpayers. Tax regimes have to be understandable. Their administration has to be simple and cost-effective for the government. “We will have to work on it this year and the next one in order to suggest clearer, more transparent, and more understandable conditions as from 2023. We will also have to raise contributions to the state treasury, too,” the finance minister summarized.

All the suggested novelties were presented before the head of state as a concept for amending the approaches to taxation and to self-employed business operation. The concept also suggested placing more emphasis on the development of self-employment. There are plans to create a digital platform, which will help promptly and conveniently register one's business and make various payments. “The concept was approved on the whole,” Yuri Seliverstov noted.

The official pointed out that raising taxes was not the idea. The government would like self-employed entrepreneurs to contribute more to the payment of taxes. As an example he mentioned that owners of farm stays pay a tax as small as two base amounts per year. Small farm stays and large farm stays, which have evolved into large tourism complexes, pay the same tax rate.

“Simply raising the tax rate from two base amounts to ten base amounts will obviously put a burden on the farm stays, which are located far off the beaten track, and on those, who are busy modernizing their farm stays. On the other hand, owners of large farm stays will just have to pay a little bit more. In this case it would be logical to set the tax size depending on the size of the earnings,” Yuri Seliverstov said.

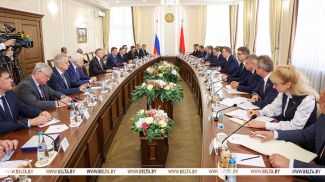

BelTA reported earlier that during the government conference with the Council of Ministers on 22 July Belarus President Aleksandr Lukashenko gave instructions to better regulate the work of self-employed entrepreneurs and self-employed individuals.

Aleksandr Lukashenko stressed that he had repeatedly drawn attention to the need to set things right in this sphere. First of all, it is necessary to work out a system to clearly identify who can be classified as self-employed entrepreneurs, what they are going to do, and what taxes they are going to pay. The head of state criticized the current state of affairs. Apart from that, Aleksandr Lukashenko reminded about his instruction to put a stop to backdoor salaries. “The system needs to work in a way to rule out any preconditions for paying backdoor salaries,” he stressed.

Meanwhile, tax breaks for some categories of self-employed individuals seem to be in order, Aleksandr Lukashenko believes. “We should not choke the initiative out of people. People want to work and earn. A talented person draws pictures, makes wickerwork baskets or does something that only a handful of people in our country can do. We should always support such people, including by means of tax breaks. They should simply pay small taxes and keep doing their craftwork,” he said.