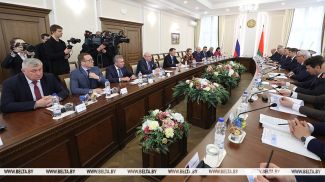

MINSK, 11 May (BelTA) – Proposals on improving the national taxation system are supposed to be submitted for consideration of Belarus' Council of Ministers in June, BelTA learned from Piotr Prokopovich, Chairman of the Entrepreneurship Development Council, on 11 May.

According to the source, the Finance Ministry is expected to forward proposals on improving the effective taxation system to the Council of Ministers in early June. The Entrepreneurship Development Council needs to come up with its own proposals so that the government could take them into account as it discusses taxation matters, said Piotr Prokopovich.

Piotr Prokopovich stated that taxation is an integral part of any state. “How taxes can be used in the best way possible is the question. Taxes need to provide for the state budget in full. Revenues need to be higher than they were or at least as high as they were. But revenues cannot be raised by increasing the tax burden. Instead revenues should be raised thanks to increased economic activity,” said the chairman of the Entrepreneurship Development Council.

In his words, working out a taxation system able to stimulate investments, including domestic ones, in the development of all branches of the national economy as well as state and private enterprises alike is the main goal.

Chairman of the Belarusian Union of Entrepreneurs Alexander Kalinin presented proposals of the private sector regarding the improvement of the taxation system. Belarusian private companies would like to see rescinded the right of municipal government agencies to apply multipliers to the real estate tax and the land tax while increasing revenues from indirect taxes.

Belarusian businessmen would also like the government to allow commercial entities to keep income records based on cash received. The government is asked to raise the annual limit, which allows using the simplified taxation system without VAT, to at least the Russian level where it will be set at RUB150 million as of 1 January 2018.

Proposals were voiced to disallow commercial entities, in which charter capital the share of legal persons exceeds 25%, to use the simplified taxation system. Proposals were voiced in favor of simplifying the paperwork for buying merchandise lots worth at most €1,000 in the Eurasian Economic Union with cash.